Flock empowers landlords to exit their rentals with the 721 exchange.

Why do enduring growth drivers support owning single-family rentals?

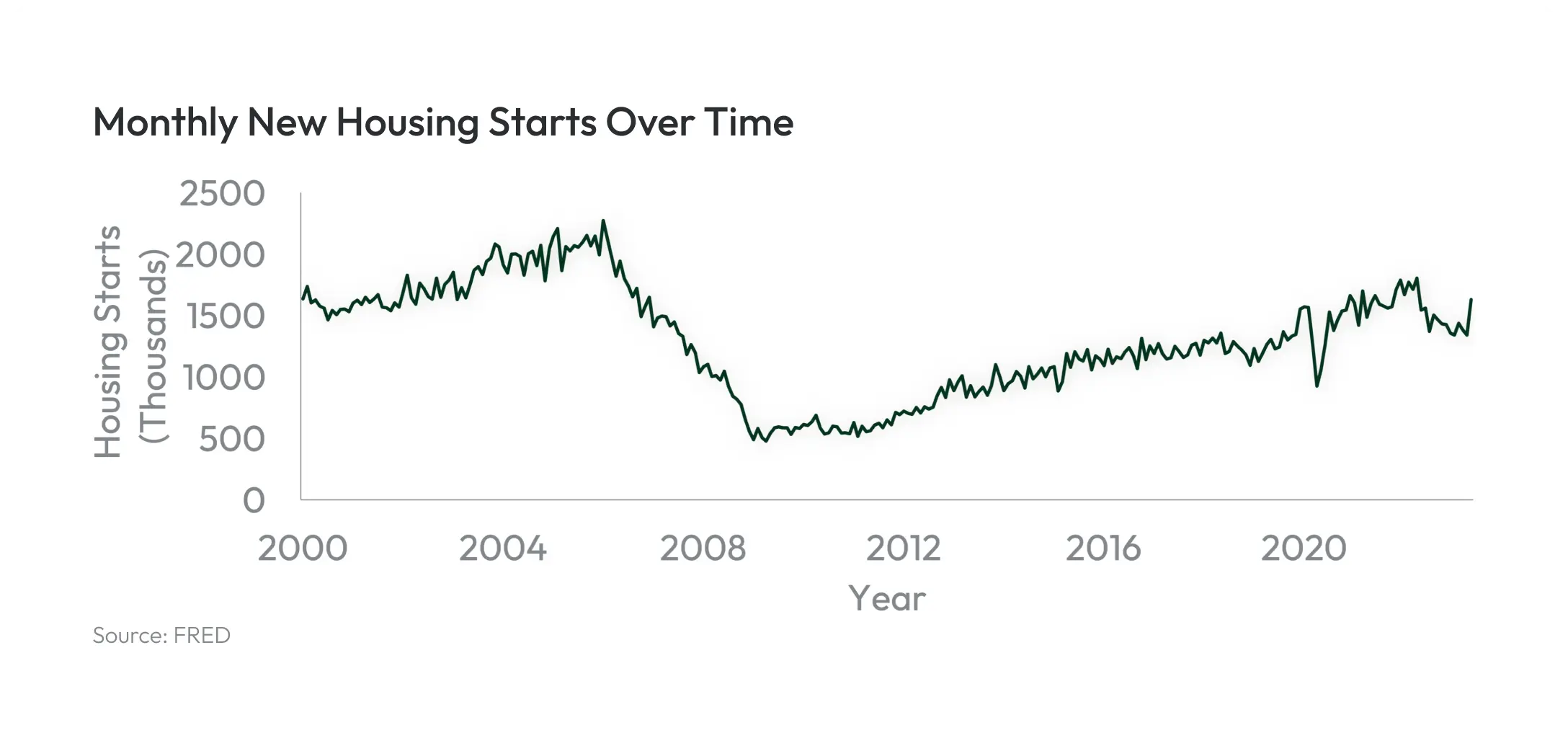

Housing ShortageAfter the sharp crash in building post the Great Financial Crisis, monthly new housing starts are still below where they were in 2000, and the US is 4 million units short of housing demand. The rise of NIMBY* policies have also suppressed construction of new housing.People who own homes are trapped with golden handcuffs, exasperating the shortage--80% of homeowners have sub-5% mortgage and 25% sub-3% fixed rate mortgages, making it cost-prohibitive to trade up to another house.*NIMBY, an acronym for "Not In My Back Yard," refers to the opposition by residents to a proposed development in their local area.

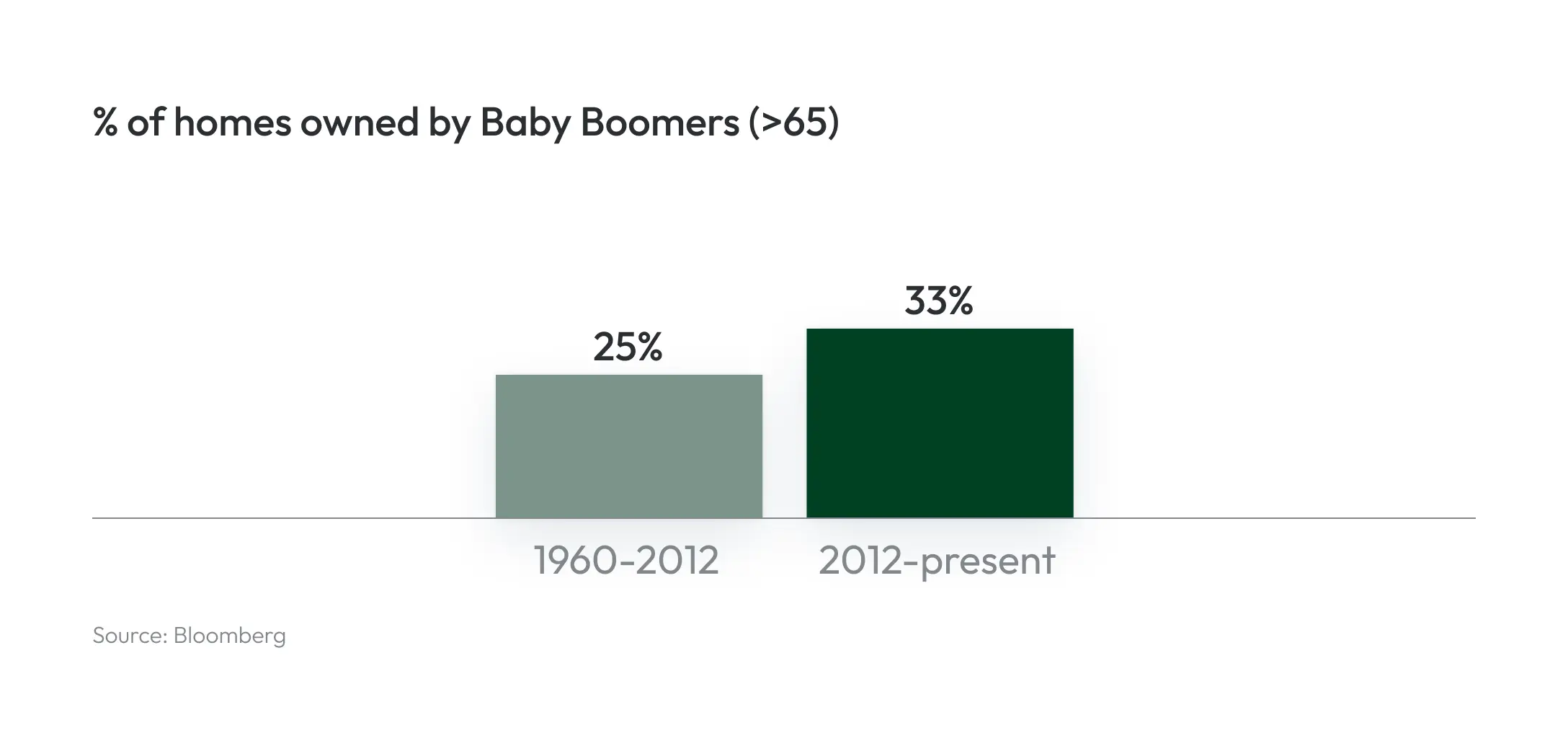

DemographicsDemographic shifts such as more single-person households, millennials delaying homeownership, and an aging population preferring rentals, sustain demand for single-family rentals. Millennials are entering peak household formation years, tapping into a growing rental market affected by these trends. As Baby Boomers start to retire, many may downsize from larger homes to more manageable properties, with some opting to rent to avoid homeownership responsibilities in later years.

Post-COVID ShiftThe pandemic has accelerated the trend of people moving away from densely populated urban areas to more suburban locations for a more flexible living arrangement.Single-family homes in suburban areas have become more desirable due to the increased demand for space, privacy, and access to outdoor amenities, which has driven up their value.

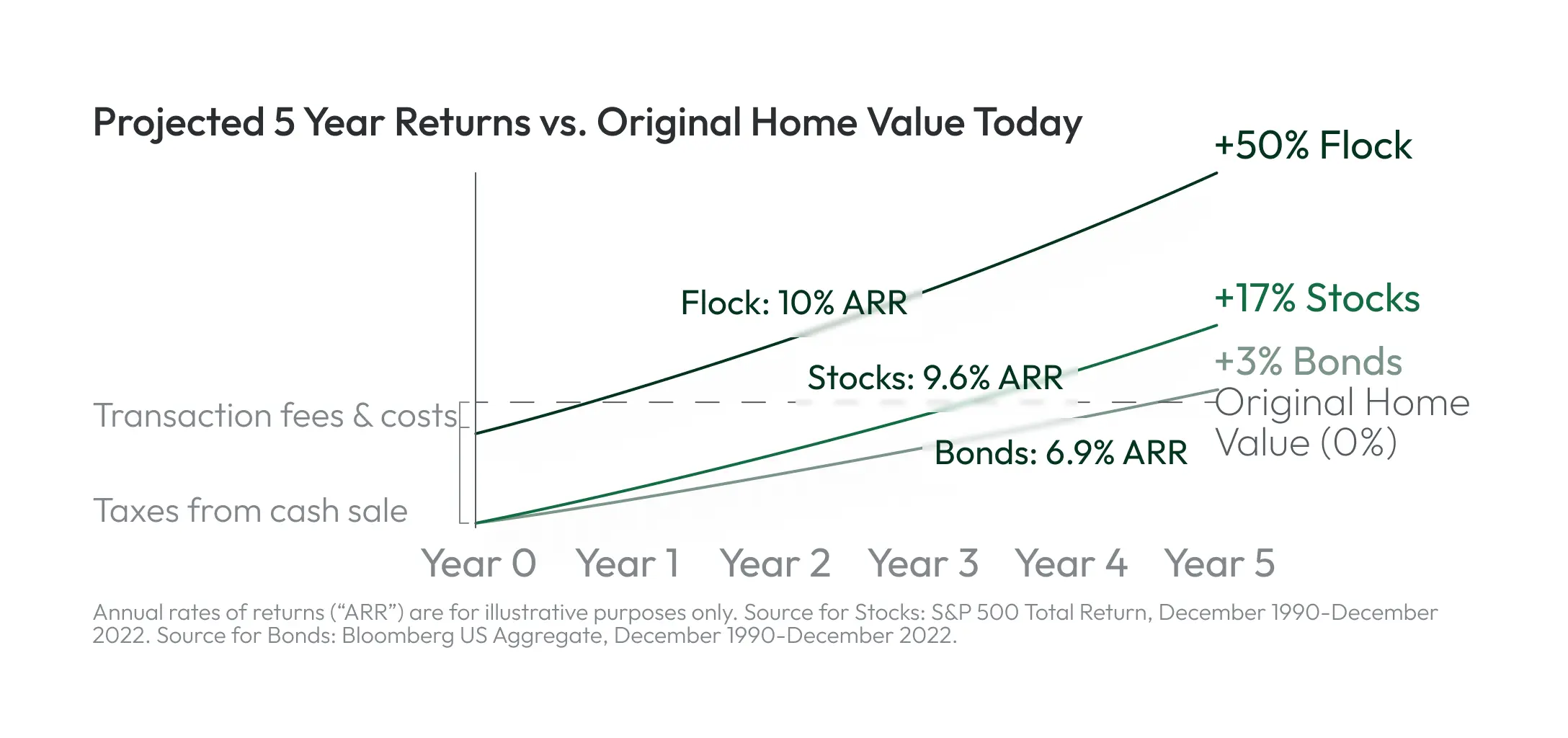

Rent vs Sell CalculusChoosing between renting or selling a single-family home balances long-term income against immediate capital. Renting offers steady cash flow and tax benefits but requires active management and reduces liquidity. Selling provides quick funds and eliminates management duties but may incur capital gains tax and depreciation recapture.The 721 exchange is strategic for exiting direct property ownership, allowing investors to stay invested in real estate, defer capital gains taxes, and reduce management burdens while increasing liquidity and diversification.

How does Flock select markets?

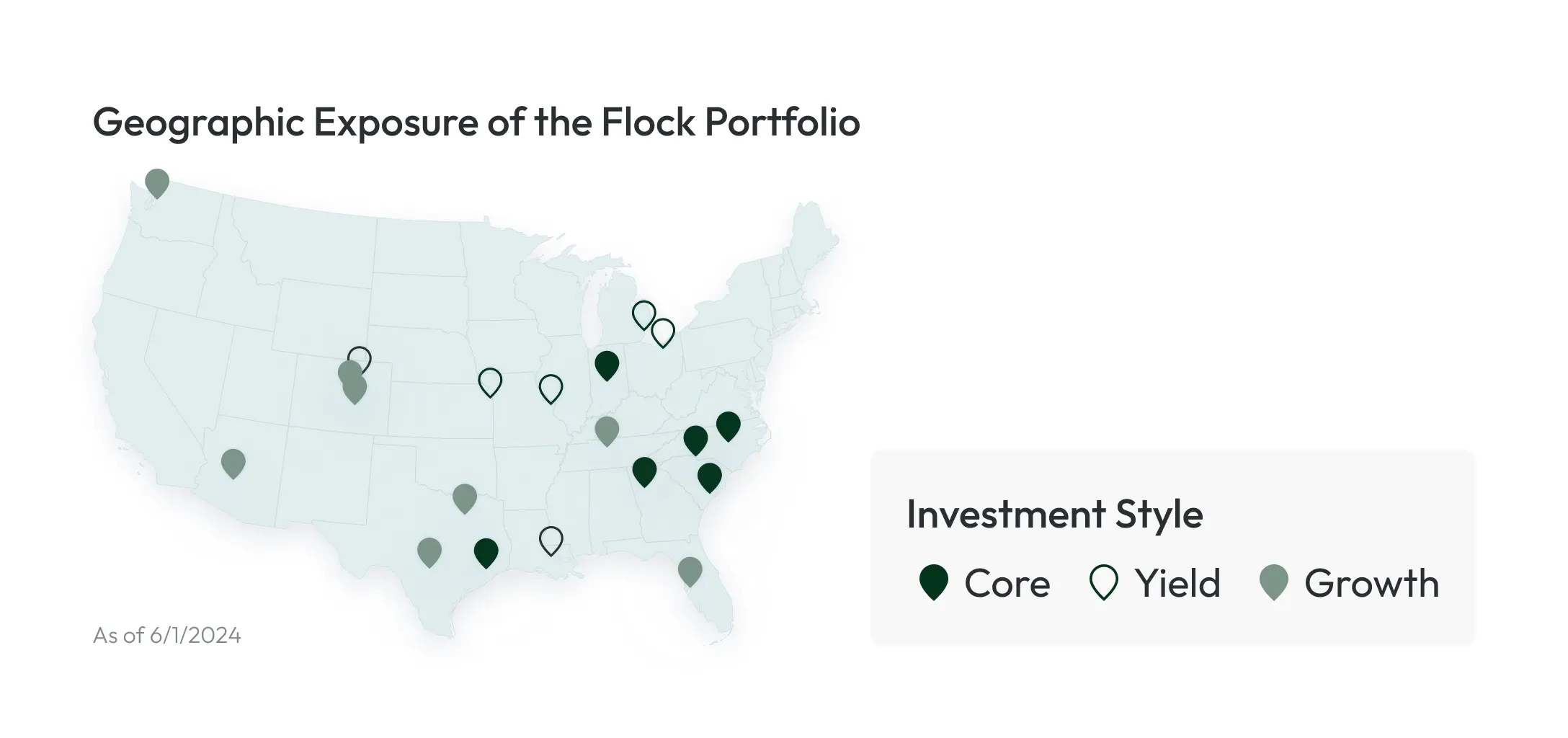

Market Potential & DiversificationFlock targets high-potential markets, focusing on favorable risk-return profiles, attractive yields, and home price appreciation. We evaluate these markets by analyzing the economic environment, industry presence, regulatory conditions, and population growth fueled by job opportunities and quality of life. This strategy ensures steady housing demand.Flock's diversified portfolio offers exposure to single family rentals across multiple markets, with an array of high yield as well as high appreciation assets in desirable markets across the country.

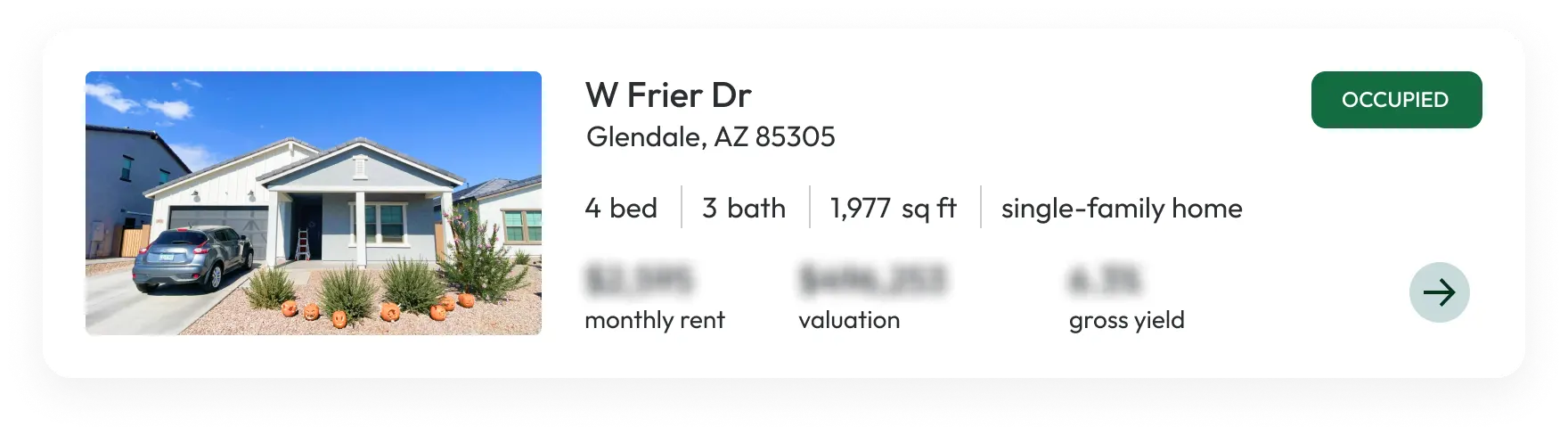

Data-driven UnderwritingFlock uses a variety of data points to underwrite valuations for assets. Our valuations consider data like rental and sale comps, market stability, and our understanding of assumptions to ensure a fair and accurate valuation for every asset.We execute inspections on all assets in order to provide a final valuation, document asset condition and determine remodel costs necessary to bring assets up to Flock Standards.

Professional Asset ManagementFlock's team, with decades of experience at top global real estate investment institutions, aims to enhance the lives of real estate owners. Our seasoned Asset Management Team applies their extensive expertise to meticulously manage each asset, ensuring value and peace of mind for tenants and clients alike. We also use our market knowledge to strategically identify and seize opportunities within new markets, aligning with our operational capacity.

Why Flock?

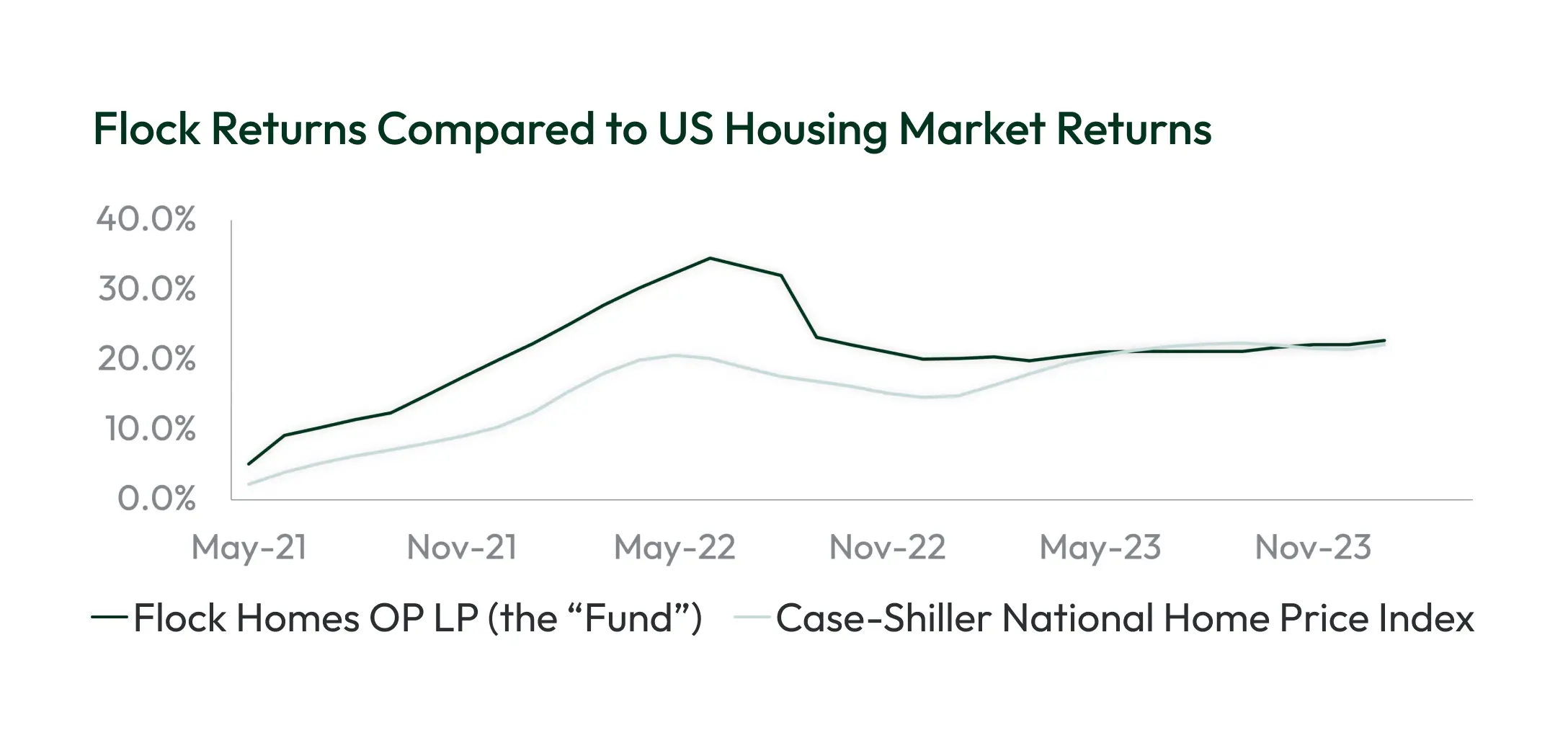

About the Flock FundWe empower landlords to exit their rentals with the 721 exchange. Exchange your rentals for ownership in a professionally managed real estate fund, designed specifically for retiring landlords.Flock offers a low-cost, low-leverage, diversified portfolio of single-family rentals that closely tracks the US housing market.

Frequently Asked Questions

How does Flock Homes operate the homes in the fund?

Flock Homes operates all homes in the fund as long-term rentals. We have a local team in every market where we own homes, complemented by third-party property managers that we actively manage. We believe local, responsive, and knowledgeable property management delivers the best experience for residents, the community, and ultimately, the fund clients.

How does Flock Homes determine the value of the fund?

The fund’s value is refreshed every quarter using a combination of automated valuation models (AVMs) and third-party appraisers. Every home in the fund is required to be appraised by a third party appraiser once every 24 months.

What returns should I expect from joining Flock?

Flock’s fund targets an 8-10% internal rate of return to its investors based on the performance of the portfolio of homes in Flock’s fund. This return encompasses 1) income generated by the portfolio’s rental activity and 2) appreciation of your equity based on the price performance of the portfolio’s real estate. For many Flock clients, the peace of mind and countless hours they reclaim is an invaluable benefit.

What fees does Flock have?

Flock Homes charges investors two simple fees: a one-time onboarding fee of 6% and an ongoing annual management fee of 1%. The onboarding fee is deducted from the value of your received equity in Flock’s fund, and the ongoing management fee is collected from the net operating income of the fund. Investors typically do not need to separately provide cash to transact or own with Flock. Unlike many other funds, Flock does not charge a performance fee. Read our Fee Documentfor more information on our fees.

What access do I have to the portfolio and my financial performance?

Upon joining Flock’s fund, you will gain access to your personalized online Client Portal, where you will have full detailed reporting on your financial performance. You also gain full visibility into the fund’s financials and real-time asset-level activity, such as individual leasing, renovations, and more. To preview the portal, click here to submit your rental address for an evaluationand one of Flock's Single Family Rental Directors can provide you with a complimentary demo.

Landlords, retire and minimize taxes.

Want more information?