Here's how Flock makes it work.

The 721 exchange, made accessible to landlords.

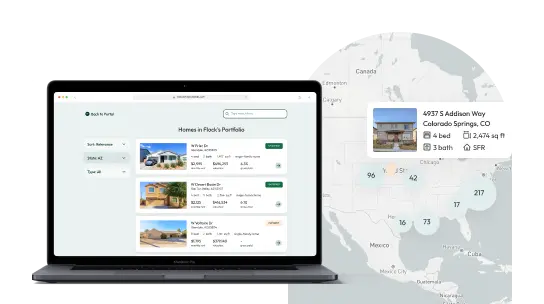

Section 721 of the US Internal Revenue Code (“the 721 exchange”) is a tax strategy that has been used by Wall Street investors since the 1950s.Flock Homes is the first to bring it to individual investors. With Flock, landlords can use the 721 exchange to seamlessly exchange their rental properties, tax-free, for direct ownership in a residential real estate fund.

What is the process?

STEP 1

Get a valuation & discuss your needs.Get a free, no-obligation valuation on your properties, and discuss with one of our experienced Single Family Rental Directors whether Flock is the right fit for you.

STEP 2

Perform due diligence.We’ll provide you resources, such as fund financials and reference calls with current investors, to vet us. In parallel, we’ll conduct a home inspection to lock in your valuation.

STEP 3

Sign the Contribution Agreement.Once you accept the valuation, we’ll draft a Contribution Agreement (similar to a Purchase and Sale Agreement) for you to sign.

STEP 4

Complete onboarding to close.We’ll help you complete the online title and closing process, all from the comfort of your own home. Congratulations on joining our fund of 1010 homes!

STEP 5

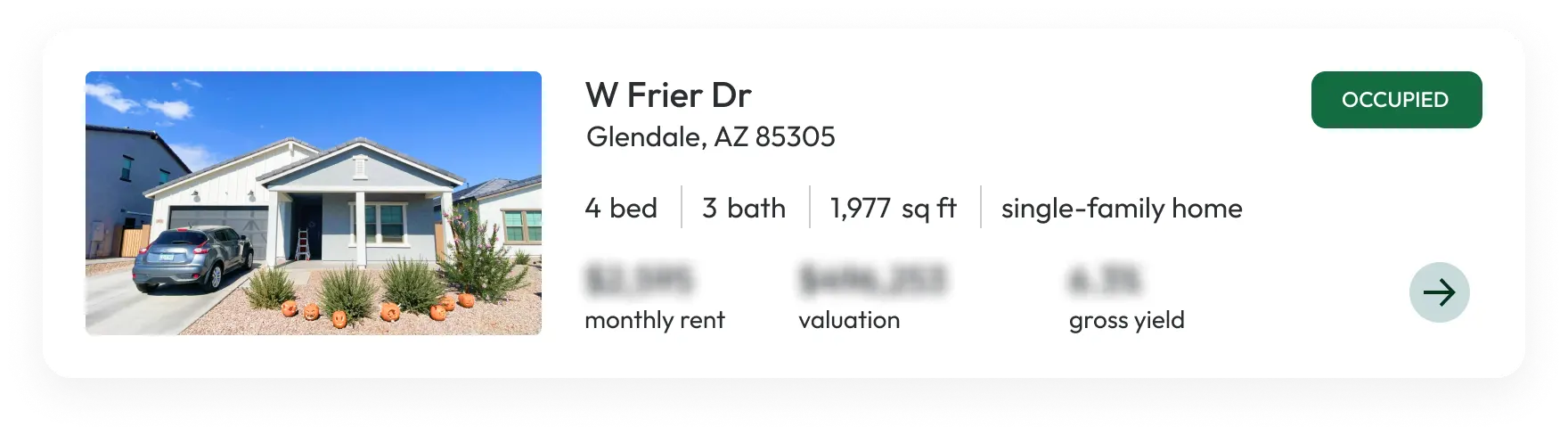

Owning with FlockAs a Flock Client, access your investor portal anytime, anywhere, to view fund financial details and fund activity. Passively own with full transparency.

STEP 6

Earning with FlockEvery quarter, take cash flow or leave it in to build your nest egg. Within the portal, view your financial performance and detailed tax performance.

STEP 7

Tax & Estate Planning with FlockFlexibly allocate your Flock investment to your heirs (who receive a step-up in tax basis upon passing) or redeem them for cash to spread out your tax burden.

Keep the benefits of real estate, without the hassle.

Seamless Exchange

Collaborative, streamlined transaction

No qualified intermediaries necessary

No identification or exchange periods

Effortless Ownership

Easy and reliable earnings

Transparent and detailed reporting

Flexible tax and estate planning

Landlords, retire and minimize taxes.

Want more information?