Understanding REITs and Alternative Investment Options

Published July 22, 2025Share this article

For investors seeking a passive way to build wealth through real estate, there are several proven strategies to consider. Real Estate Investment Trusts (REITs) are a well-known way to invest in real estate, but they're primarily designed for cash investors rather than property owners looking to transition existing holdings. Understanding what REITs are - their benefits, limitations, and how newer approaches address the specific needs of property owners - can help you make the right decision for your situation.

What Are REITs?

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate across various property sectors. Created by Congress in 1960, REITs pool money from multiple investors to purchase and manage real estate portfolios, then distribute rental income and profits to shareholders. Think of them as mutual funds for real estate – you buy shares representing ownership in a diversified portfolio of properties rather than owning individual buildings directly.There are several types of REITs, each offering different investment approaches and opportunities. REITs can focus on equity investments by directly owning properties, or mortgage investments by financing real estate through loans and securities. They also span various property sectors including residential, office, retail, industrial, and hospitality real estate. Additionally, REITs offer different liquidity options – public REITs that trade on major exchanges provide daily liquidity, while private REITs offer potentially higher returns but with more limited liquidity options.The Benefits of REIT Investing

REITs offer compelling advantages for real estate investors. Professional management means experienced teams handle all aspects of property operations, eliminating the day-to-day responsibilities and operational burdens of direct ownership. Diversification comes naturally since REITs typically own dozens or hundreds of properties across multiple markets, reducing the concentration risk of owning individual assets.REITs also benefit from pass-through taxation, meaning they avoid the double taxation that affects regular corporations. This tax-efficient structure is what enables REITs to distribute most of their income directly to investors rather than retaining earnings at the corporate level.Income generation is built into the structure, as REITs must distribute at least 90% of their taxable income to shareholders as dividends, providing regular income streams. The lower barrier to entry allows investment with relatively small amounts of capital, making institutional-quality real estate accessible. For publicly traded REITs, liquidity means shares can be bought and sold on stock exchanges, providing immediate access to investment capital.The Disadvantages of Traditional REITs

Despite their benefits, traditional REITs have significant limitations for existing property owners looking to transition from direct ownership. The biggest drawback is that REITs don't always accept direct property contributions – you may have to sell your properties first and use the after-tax proceeds to purchase REIT shares. If you sell property to invest in a REIT, you'll trigger capital gains taxes and depreciation recapture that can consume 20-30% of your gains, substantially reducing your investable capital.Public REITs also suffer from market volatility, trading like stocks and subject to market sentiment that may not always reflect underlying real estate values. While private REITs may avoid this market volatility, they typically have significant liquidity restrictions, often limiting redemptions or requiring long hold periods. Retail REIT shareholders have no say in property selection, management decisions, or strategic direction.UPREITs: A Bridge to Direct Property Contribution

One important evolution is the UPREIT (Umbrella Partnership Real Estate Investment Trust). UPREITs allow direct property contributions through their operating partnership structure, where property owners can contribute real estate in exchange for "operating partnership units" that sit below the REIT, rather than directly into REIT shares. Exchanging assets for those operating partnership units may provide tax deferral benefits through what's known as a 721 Exchange.When it comes time to liquidate, UPREIT unit holders can convert their operating partnership units to publicly tradable REIT shares (after any required hold period) and then sell those shares on the open market. The conversion to REIT shares is a taxable event that triggers the previously deferred capital gains, while the subsequent sale of REIT shares on the public market provides the liquidity that makes UPREITs attractive to large property contributors.However, many UPREITs are inaccessible to the masses. By only accepting larger property contributions (often $10+ million), primarily in commercial and across classes in specific geographic locations, most UPREITs are not a viable option for individual rental property owners.How Flock Operates Differently

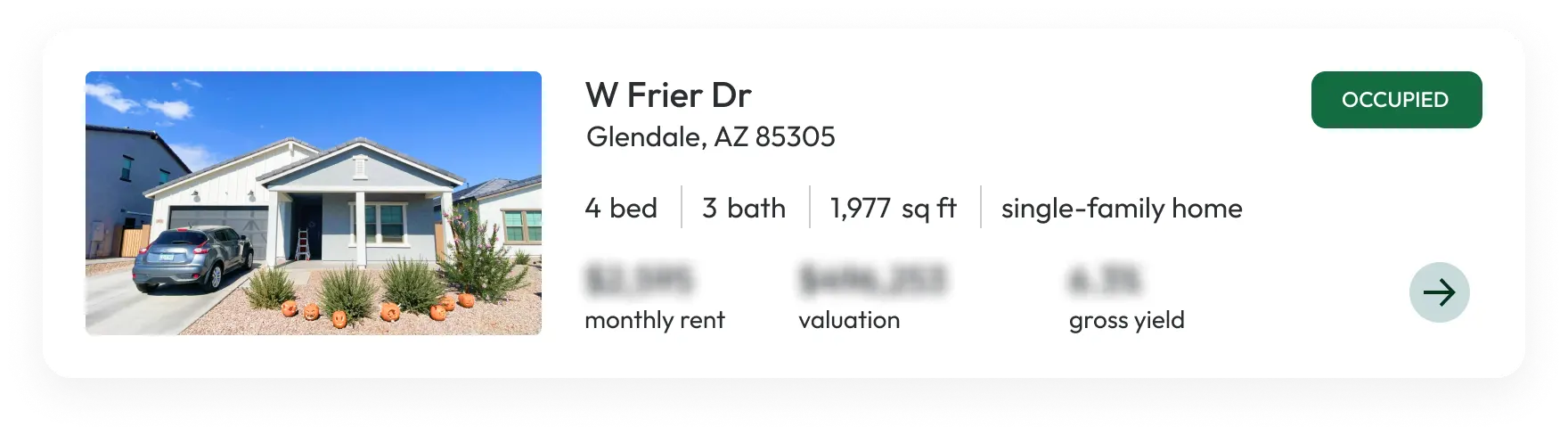

In contrast to many UPREIT structures, Flock operates using a model that is specifically designed for individual landlords. We accept direct property contributions into our evergreen real estate fund via the 721 Exchange, enabling you to exchange rental properties directly for ownership units in our diversified portfolio.The 721 Exchange allows you to defer capital gains taxes and depreciation recapture that would be due in a traditional sale-then-invest approach. While traditional UPREITs focus on large commercial properties, Flock’s flagship SFR Fund targets individual landlords with single-family rentals. Our platform simplifies the complex legal and tax mechanics of a 721 Exchange, making institutional real estate ownership accessible to individual investors.Our fee structure includes a 6% onboarding fee (measured as a percent of your property value being exchanged into the SFR Fund) and 1% annual management fee (measured as a percent of your net equity in the SFR Fund) with no hidden costs. Like other assets including real estate, partnership units also provide "step-up in basis" benefits for heirs that can eliminate deferred capital gains taxes for the next generation.The exchange process begins with getting a free property valuation and discussing your needs, followed by a review period where you examine fund financials and speak with current investors while we conduct a property inspection and other property-level due diligence. After receiving a final valuation post-inspection, you sign a contribution agreement and complete the online closing process. Once closed, you gain access to an investor portal with real-time portfolio insights and begin to have access to quarterly cash flow.Understanding Your Options

Traditional REITs may be appropriate for investors seeking liquidity and small initial investments in real estate assets, while utilizing the 721 Exchange may better serve real estate investors looking to transition from direct ownership while deferring taxes and maintaining real estate exposure.For owners who have built substantial equity in rental properties and want to retire from landlord responsibilities without triggering significant tax consequences, the 721 Exchange solution provides an advantageous path forward.Consider consulting with tax and financial advisors to understand how each option aligns with your specific situation and long-term wealth-building plan.To learn more about how Flock can support your real estate investment goals through the 721 Exchange, visit us here.Landlords, retire and minimize taxes.

Want more information?