The Long-Term Benefits of Single-Family Rental Investment

Published October 3, 2025Share this article

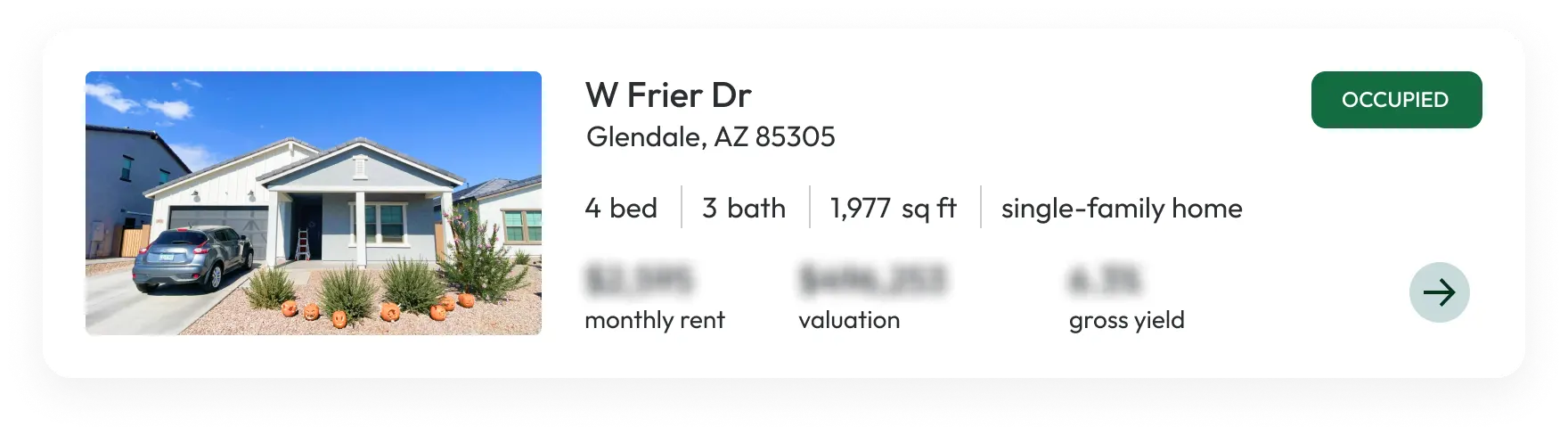

Today’s real estate investors have a wide range of asset class options, including commercial properties, multifamily apartments, office buildings, and industrial spaces. Among these choices, single-family rental investing stands out as one of the strongest long-term strategies, offering unique advantages that other real estate sectors struggle to match.While today's environment presents new considerations around insurance costs, maintenance strategies, and operational efficiency, the fundamental investment thesis for SFRs remains exceptionally sound.The data tells a compelling story: Single-family rental investments are poised for sustained risk-adjusted outperformance, driven by persistent housing shortages and shifting demographic trends. With vacancy rates consistently lower than those of apartments and tenant turnover on the decline, SFRs offer a stable foundation for long-term wealth creation. As homeownership remains out of reach for many, the rising demand for professionally managed single-family rentals signals strong future performance, making SFRs a cornerstone for investors looking to build resilient, high quality portfolios over the coming decade.For investors evaluating their real estate strategy, understanding why SFRs maintain their position as a premier long-term investment can help inform portfolio decisions for years ahead.

The Housing Supply Crisis Creates Sustained Demand

America faces a severe housing shortage that will persist for years. The U.S. is approximately 4 million housing units short of demand – a deficit building since the Great Financial Crisis in 2008 when construction activity collapsed.Single-family rentals represent a significant portion of the overall U.S. rental housing inventory, with the majority of SFR stock being decades old and relatively little new construction in recent years. This structural shortage supports sustained occupancy rates and pricing power.With homeownership becoming less attainable due to high prices and interest rates, more families are choosing to rent long-term, creating strong ongoing demand for professionally managed SFR portfolios.Unmatched Economic Resilience

SFRs demonstrate remarkable resilience during economic downturns because they fulfill a fundamental human need. Unlike other real estate sectors that face demand volatility during recessions, SFRs remain largely insulated from economic shocks due to the essential nature of housing.This resilience extends to interest-rate sensitivity. While rising rates can impact property values across all real estate sectors, SFRs typically show less volatility than commercial properties or even multifamily apartments. The essential demand for housing means that rental markets for single-family homes remain more stable regardless of broader economic conditions. Additionally, unlike office properties disrupted by video conferencing or retail spaces challenged by e-commerce, SFRs also remain relatively immune to technological disruption. Single-family rentals also provide an effective hedge against inflation. As the dollar's value decreases and goods cost more, real estate retains its value and often grows faster than inflation, protecting wealth during periods of economic uncertainty.As mentioned previously, SFR vacancy rates have stayed consistently below apartment rates, with operators pointing to an overall shortage of SFRs and lower turnover as key drivers. Single-family rentals have shown steady rent growth, remaining resilient through major economic downturns – including the dot-com crash, the global financial crisis, and the Covid-19 pandemic – while apartment rents have tended to be more volatile during these same periods.And the demand remains. Millennials have reached the life stage where many prefer single-family housing over apartments, while their ability to purchase homes is constrained by high prices and savings challenges. SFRs also appeal to empty nesters, retirees, and temporary residents.Superior Liquidity and Price Transparency

SFRs offer liquidity advantages compared to many direct real estate investments due to their broad buyer pool, which includes both individual homeowners and investors. This dual market demand creates more potential buyers than commercial properties or large multifamily investments that appeal primarily to investors.Single-family homes trade regularly in transparent markets with abundant comparable sales data, providing clear price discovery that many other real estate sectors lack. This transparency becomes especially valuable during market transitions, when understanding current market values is critical for investment decisions.While commercial properties often face longer marketing periods, SFRs in desirable locations generally attract buyer interest more quickly. This liquidity advantage can give SFR investors more flexibility to adjust their portfolios, though transaction timelines vary based on market conditions, location, and pricing.Professional Portfolio Benefits

SFRs offer significant advantages for long-term wealth building that become amplified in professionally managed structures. Tenants generally view single-family residences as homes rather than temporary housing, taking better care of properties and staying longer. This stability translates to more predictable income streams and reduced operational costs for fund investors.Investors can more easily achieve geographic diversification across different markets, economic sectors, and demographic profiles in SFR vs. other more capital intensive asset classes. This diversification provides exposure to multiple regional economies and housing markets, helping to reduce concentration risk while maintaining real estate exposure.Each property in a diversified portfolio creates separate income streams across different locations and tenant bases. When one market faces challenges, properties in other markets may continue generating returns. This geographic spread can offer some protection against localized economic downturns, natural disasters, or market-specific issues.Institutional investors with sufficient scale may have certain operational advantages relative to smaller owners in this fragmented market. Professional fund management can enable diversification strategies that might require untenable capital and expertise for individual investors to implement independently.The Path Forward: Professional Management Solutions

These operational challenges don't diminish the fundamental investment case for SFR exposure. Instead, they highlight the need for professional management solutions that preserve real estate investment benefits while eliminating day-to-day operational burdens.This is precisely why Flock developed our 721 Exchange platform. We enable property owners to maintain their SFR investment exposure through a professionally managed, diversified portfolio while eliminating individual property management responsibilities. You keep the long-term benefits of SFR ownership – cash flow, appreciation potential, tax advantages, and inflation protection – without the operational complexity.Conclusion: Maintain Your SFR Conviction

Single-family rentals may face legitimate near-term challenges, but their fundamental investment characteristics remain as compelling as ever. The housing shortage provides sustained demand tailwinds. Essential housing needs support recession resilience. Market liquidity offers flexibility. Technology immunity provides security.Rather than abandoning SFR exposure due to management complexity, consider solutions that preserve investment benefits while eliminating operational burdens. A goal could be optimizing your relationship with the asset class, not exiting it entirely.For real estate investors considering their long-term strategy, SFRs may deserve a central role in portfolio construction. The question likely isn't whether to maintain SFR exposure, but how to structure that exposure for maximum benefit with minimum operational complexity.To learn more about how our 721 Exchange enables long-term SFR investment exposure without traditional landlording responsibilities, visit us at flockhomes.com.Landlords, retire and minimize taxes.

Want more information?