Flock Expands into New Asset Classes with $20M Series B Funding

Published May 13, 2025Share this article

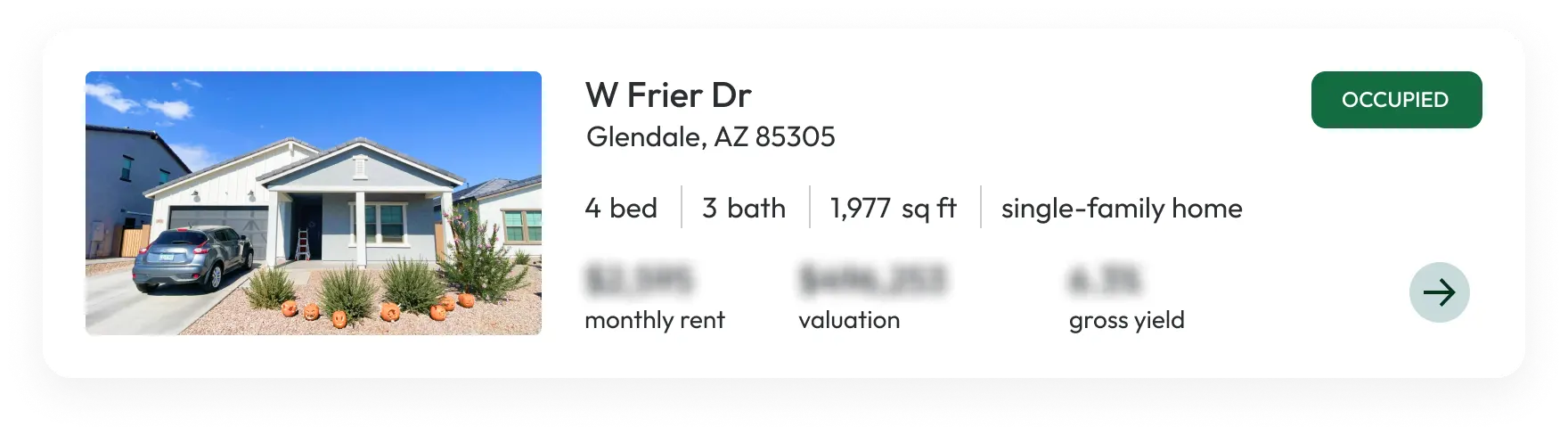

At Flock, we've spent the last four years pioneering a solution to offer rental property owners the most cost-efficient and seamless exit available. By leveraging the 721 Exchange – a powerful mechanism traditionally reserved for ultra-high-net-worth investors – we've created a path that provides everyday Americans with tax benefits, steady cash flow, and peace of mind. Our partnerships with over 150 families have grown our Single Family Rental Fund to more than 860 homes nationwide, representing nearly $200 million in real estate. We have received thousands of inbounds and have never once compromised on price, quality, or risk.Today, we're thrilled to announce two major milestones: Flock is expanding into new real estate asset classes, and we’ve closed a $20 million Series B funding round with new investors alongside all our existing major investors.We’re starting our expansion with Multifamily and Manufactured Housing, two asset classes that are adjacent to our existing operations and dominated by smaller, fragmented owners who increasingly lack the desire to own yet struggle to find attractive exit options. Our Multifamily strategy will focus on buildings with 5 to 200 units, in collaboration with local Operating Partners. For Manufactured Housing, we’re focused on mobile home park communities ranging from 5 to 500 units, primarily across the West, Midwest, and South – regions where we see strong potential to create value for both owners and the communities.This expansion is backed by our $20 million Series B, led by Renegade Partners with continued support from existing investors including Andreessen Horowitz, Primary Venture Partners, Susa Ventures, 1Sharpe Ventures, and others. These funds will fuel our next phase of growth, enabling us to bring on exceptional talent, build technology to drive down costs and ramp up efficiency, and scale operations. Following this raise, we’re excited to announce that Renata Quintini, Co-Founder and Managing Director of Renegade Partners, has joined our Board.For clarity, this capital raise supports our management company, Flock Homes, Inc., and does not impact the structure or terms of the investment Fund. For our clients, everything remains the same – only now, with even greater long-term backing and validation of our model.Looking ahead, we’re preparing to expand into additional real estate asset classes, including Self-Storage, Small Bay Industrial, Retail, and more. Owners interested in early access to these opportunities can join our waitlist to stay ahead of the curve.We’re incredibly proud of what we've built, but even more excited about what’s next. We invite you to join us as we continue to redefine what it means to own and exit real estate in today’s market.To explore our platform, learn about our latest offerings, and see how Flock can work for you, visit us here.Ari RubinFounder & CEO

Landlords, retire and minimize taxes.

Want more information?