Can you live in a property you acquired via 1031 exchange?

Published September 15, 2022Share this article

Real estate investors and landlords often use a 1031 exchange to swap one rental property for another while deferring capital gains tax. This allows them to build their long-term wealth without having to pay taxes (yet).Nevertheless, some circumstances might lead landlords or investors to ask the question: "Can you live in a property you bought via 1031 exchange?"Technically, no. You can't live in a property you acquired through a 1031 exchange. Well, not for more than a few days every year, at least. However, you can convert your 1031 exchange property into a primary residence as long as you follow the IRS rules (warning, there are a lot of them).Below, we'll walk you through steps that may allow you to eventually live in a 1031 exchange property after converting it into a primary residence. However, if you're going this way to defer taxes of selling, we'll also share another option to do so, while also living where you want!

Can you live in your 1031 exchange property?

A 1031 exchange is used on properties intended for trade, business, or investment. When you purchase a property with the intention of renting it out to tenants, it's considered an investment property.Your personal residence isn't primarily an investment—it's a home. Yes, you might view it as a long-term investment, as well, but that's not how the IRS sees it. Because of this, a primary residence - neither the property you’ve recently bought or sold - can be part of a 1031 exchange.Yet, slight workarounds can help you temporarily stay in a 1031 exchange property (read: not primary residence) without triggering a problem with the IRS.For example, you can stay in the property as long as your "personal use of the dwelling unit does not exceed the greater of 14 days or 10 percent of the number of days during the 12-month period that the dwelling unit is rented at a fair rental."Any day you spend at the dwelling unit "for personal purposes" is counted towards your total.However, intentions change. What if down the road you decide you want to make one of your investment properties your permanent home? Can you convert it into a personal residence later, or is it now forever labeled as an investment property by the IRS?You'll be happy to know that you can convert a 1031 exchange property into a personal residence. You just need to follow the IRS's rules.How to convert your replacement property into a personal residence

Here's what you need to do to convert your replacement property into a personal residence. First, you need to make sure you don't violate the rules of owning a 1031 exchange property.Here's how to make sure you don't lose your tax deferment status:- Hold for productive use: You can't 1031 exchange property and let your family move in. It needs to be used in a trade or business or for investment.

- Own for sufficient time: You must own the property for at least 24 months following a 1031 exchange.

- Rent it out: Within each of the two 12-month periods following the exchange, you must rent the dwelling at a fair rental rate for 14 days or more and make sure you don't stay in the property more than the greater of 14 days or 10% of the amount you rented it.

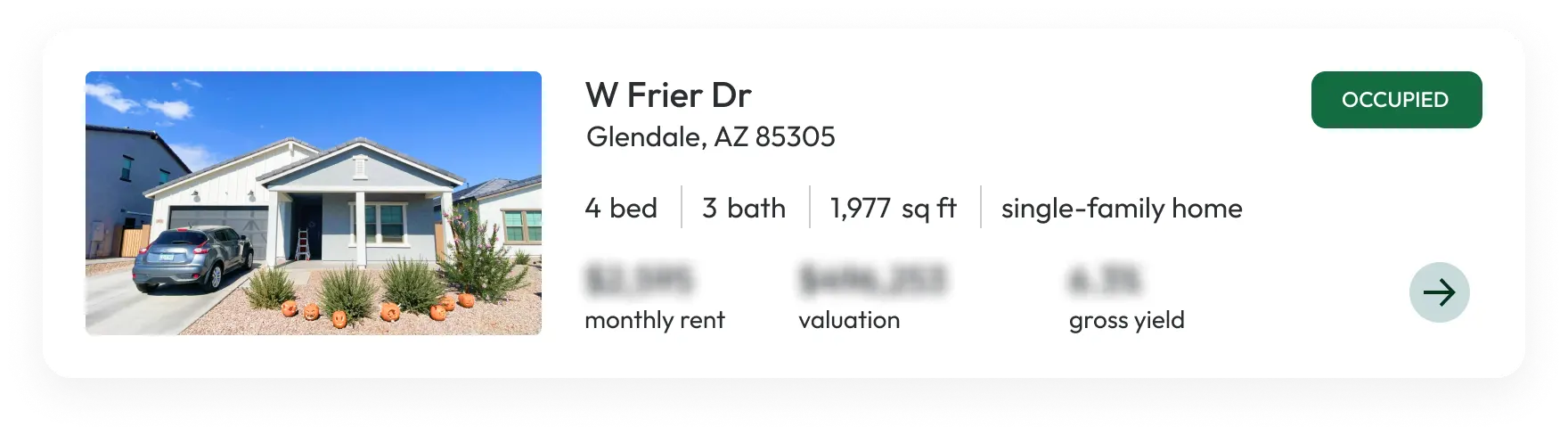

Reduce the hassle and consider Flock

If your goal is to defer the taxes of selling, you don't need to go through all the headaches above. You can use one of Flock's exchange mechanisms to park your equity with Flock and own shares in our portfolio of single family homes. You'll get steady income, upside potential, liquidity, and tax deferment. Plus, you won't have to worry about the everyday headaches of being a landlord.Interested? Get started below.Landlords, retire and minimize taxes.

Want more information?