An End-of-Year Letter from Ari Rubin

Published December 30, 2024Share this article

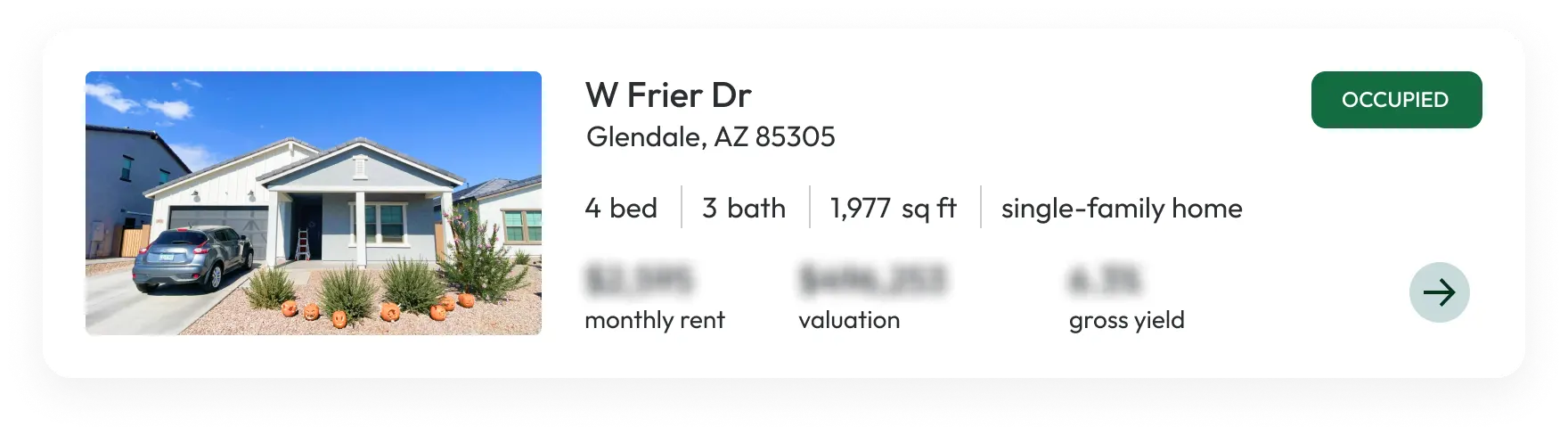

With 2024 coming to a close, I find myself reflecting on Flock’s incredible journey. What started just over three years ago with 4 homes in Denver has now expanded to an impressive 818 homes in more than a dozen markets, with a total portfolio value exceeding $175 million. This represents over 150 valued clients – families that have entrusted us with a significant investment, which, in many cases, is not only their largest financial asset but also their life’s work, built through decades of dedication. It's a legacy they've created for their children and grandchildren. This growth has been fueled by our innovative approach to solving a critical problem, a commitment to operational excellence, and a highly experienced and dedicated team.The challenge facing rental property owners in the United States is one we understand well. Millions of individuals who own rental properties eventually need an exit strategy, yet traditional options present significant hurdles. Selling typically means giving up income and future appreciation while facing substantial costs and tax implications that chew away at hard earned equity. 1031 Exchanges, while offering tax-deferred benefits, are complex transactions that do not provide a true exit strategy. As a result, many owners hold onto their properties too long, leading to deferred maintenance that not only hurts their investment returns but also diminishes the quality of life for residents and overall neighborhood vitality. This is where Flock enters: through our 721 Exchange, we offer property owners reliable passive income, freedom from management responsibilities, enhanced liquidity, and the benefits of scale through equity in a partnership that owns a diversified real estate portfolio. This solution is resonating more strongly than ever.2024 has been a year of significant strides for us. We’ve welcomed more than a dozen new talented team members, which has greatly enhanced our ability to better serve our clients across the country. In addition to bolstering our core markets, our expansion into new markets such as Cleveland, Phoenix, Memphis, and Iowa highlights the ubiquitous demand for our solution. We're now acquiring 100+ homes a quarter, and have exceeded our year-end target of 750 properties. Throughout this growth, we've maintained an uncompromising commitment to portfolio quality. We’ve declined more than double the number of homes we’ve acquired this year because they didn’t align with our stringent acquisition standards. We view managing our clients’ wealth as a responsibility that shapes every decision we make. We recognize that our reputation as trusted stewards of generational wealth is vital, and we are dedicated to building a legacy rooted in confidence and sustained value.The real estate market continues to evolve, influenced by changing economic conditions, policies, and technological advancements. With persistently high interest rates, rising property taxes and insurance rates, and increasing regulation against landlords, adaptability is key. But through all these shifts, Flock remains committed to its core mission: providing property owners with the most seamless and cost-efficient exit strategy.Our growing client base speaks to the value of our solution. Your trust has been fundamental to our success, and we deeply appreciate your continued confidence in Flock. As we enter the new year, we look forward to helping even more property owners achieve their investment and retirement goals.Wishing you all a wonderful holiday season and a prosperous new year ahead.

Landlords, retire and minimize taxes.

Want more information?