3 Year Anniversary at Flock

Published April 30, 2024Share this article

Three years ago, we embarked on the journey of building the retirement solution for landlords. 17 million people in this country own rental property, and at some point, all of them will need an exit. The problem is there’s no simple way to “retire.” Being a landlord takes work, and as every real estate owner knows, you’re liable as long as you’re on title. But selling isn’t a great option: you lose your income, your appreciation, and the taxes and costs associated with selling mean you also lose a big chunk of equity. As one of our clients, a retired mailman who started saving early to buy his first rental in the 90’s, recently said, “Owning real estate generated far more wealth in my lifetime than I ever imagined. It’s been amazing to be on this highway, but I’m now realizing that I’m looking for the exit ramp, and it’s just not there.”One potential solution many real estate investors are familiar with is the 1031 Exchange, a “real estate loophole” in the Tax Code that allows investors to sell their property and roll the proceeds into other real estate without triggering taxes. It’s a good tax-deferral mechanism if you’re looking to own a new or different type of asset, but it doesn’t provide a real exit — you’re still a landlord!

Why This Matters

What to do with the millions of reluctantly owned rental properties is an important problem to solve. It impacts current owners, residents, and communities around the country.For one, the millions of houses represent decades of sweat equity for millions of Americans - it’s trillions of dollars of hard-earned wealth needed to support retirement and be passed on to heirs. Moreover, these houses are homes for millions of families around the country. Every resident and community expects landlords to be responsible, hands-on, and attentive in providing safe and reliable housing. Retiring landlords are the first to admit they’re not interested in doing all the work to bring their houses to their highest and best use. Property managers certainly aren’t up for the task — when was the last time a property manager paid tens of thousands of dollars to add extra livable space and replace outdated appliances?Home prices have increased substantially, taxes are likely only to increase, and the millions of Americans who own rental property are only getting older. Over the last 30 years, the share of assets owned by older generations has increased substantially. According to the Federal Reserve, 70+ year-olds control 30% of all assets, nearly double what they did 25 years ago. Working Americans — households under 40 and between the ages of 40-and 54 — now have less than 35% of overall assets, down from 50% 30 years ago.While there has been talk of a silver tsunami in the housing market, more industry analysts predict the silver wave: a gradual selling of homes over the coming decades as seniors age in place and stay active longer. With existing homeowners trapped with ultra low mortgage rates, record amounts of home equity, and a decade-plus of significant underbuilding, any influx of supply will hardly meet the demands of the incoming generation of homebuyers.Rather than wait for government policy to force change, we looked to private markets to solve this problem. A tried-and-true solution exists, but it’s never been accessible to the millions of Americans who would benefit from it. So we built Flock!Flock’s Solution: The 721 Exchange

Flock offers the first direct Real Estate Exchange Fund for individual investors. Using Section 721 of the Tax Code, rental property owners exchange their homes for equity in a partnership that owns a diversified real estate portfolio across the country. This powerful mechanism has been used for decades by ultra-high net-worth individuals, their families, and institutional investors at large. It’s a great idea, but it’s hard to get started. We asked clients to entrust us with a significant portion of their net worth, and we needed to earn their trust.To start, we worked with industry-leading firms like Kirkland & Ellis and KPMG to form a highly complicated tax and legal structure to govern the partnership and 721 Exchange process. We brought on a bench of advisors and top-tier investors to build a business that would support unwavering duty to clients. We then hired a world-class team of experts — a maniacally-obsessed team excited about building on behalf of our clients. We built technology to scalably underwrite, track, and manage our existing and future portfolio.Our First Three Years

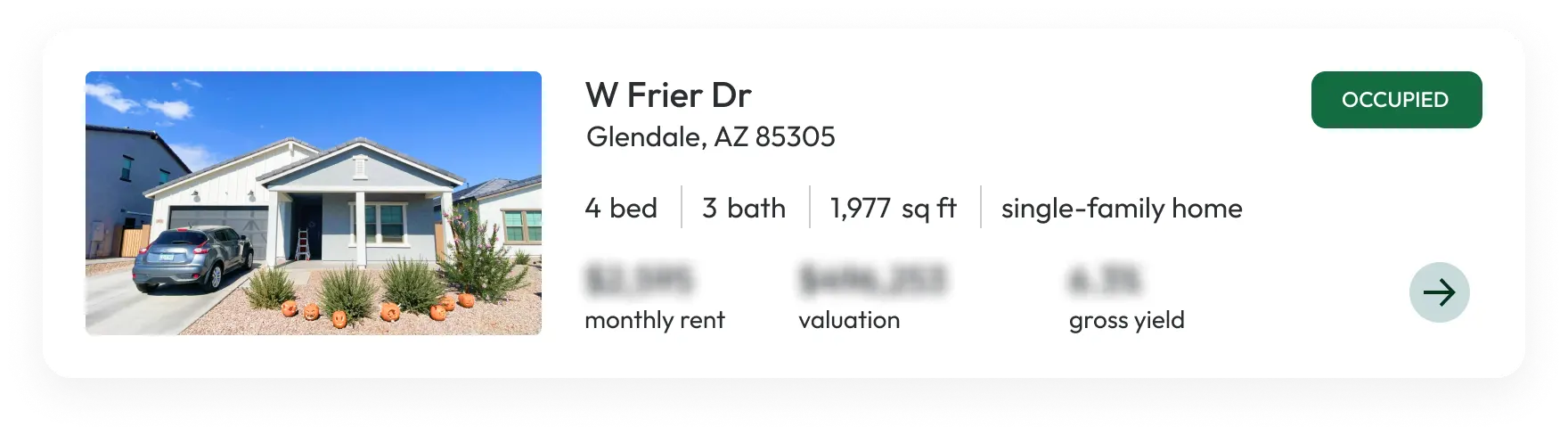

We launched in early 2021 with four homes in Denver. At the end of the year, we had 45 homes across Denver and Kansas City, providing our clients with initial exposure to geographic diversification. The following year, we grew to over 450 homes. We brought on the team and invested resources to open a larger range of markets — areas with higher yields like Raleigh, Atlanta, and Kansas City, while doubling down in areas with higher growth forecasts like Charlotte and Denver. The backgrounds of Flock clients expanded — from career real estate investors and property managers to accomplished corporate professionals with a passion for the community in which they owned property. We continued to work with landlords who owned one or two homes and those who owned hundreds of homes.Over the last year, we honed our operations. Like most other real estate investors, capital markets made growth challenging, resulting from the Federal Reserve’s fastest rate increase in history without any meaningful home price decline. We hired a new Head of Asset Management, General Counsel, and several Associates to price and manage the portfolio. We built our proprietary data lake to track portfolio and property-level operational data to surface every piece of information in our portfolio to clients. We had such positive reception to our approach to the 721 Exchange that we started licensing it to other Funds, such as Overmoon Short-Term Rentals.This year, we’re turning growth back on. With the team in place and more stability in capital markets after securing our first 8-figure cash investment directly into the Fund, we’ve never been better equipped to bring Flock to clients across the country. Our expansion into cities like Cleveland, Phoenix, and Memphis this year has been driven by the largest organic inbound we’ve ever experienced.While we’re excited about growth, it can never come at the expense of Fund performance. Over the last several months, we’ve walked away from hundreds of homes ready to sign to Flock, which we couldn’t accept due to their condition. We have a fiduciary duty to the hundreds of clients who entrust us with their net worth, and it’s a responsibility we take very seriously at Flock. Our financial track record and, importantly, our reputations as stewards of wealth will follow us forever. Starting on the right footing is paramount to success over the long term.The Future of Flock

The real estate and wealth management landscape continues to evolve. Political uncertainties, shifting market dynamics, and technological advancements pose challenges and opportunities to owners, residents, and communities. Flock is dedicated to adapting and growing, ensuring that we remain at the forefront of the industry for the benefit of our current and future clients. Our commitment remains steadfast: to provide landlords with the most flexible and reliable exit.As we celebrate this milestone, we extend our heartfelt thanks to every Flock client, partner, and team member. Your trust, support, and commitment are integral to our success.Happy third anniversary to Flock!Landlords, retire and minimize taxes.

Want more information?